Ethereum Price Prediction: Bullish Technicals and Institutional Momentum Signal Strong Investment Case

#ETH

- Technical Strength: Trading above 20-day MA with improving MACD momentum suggests bullish technical foundation

- Institutional Demand: FOMO following ATH and institutional endorsements provide substantial buying pressure

- Fundamental Catalysts: Tokenization adoption and undervaluation thesis from major banks support long-term growth narrative

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

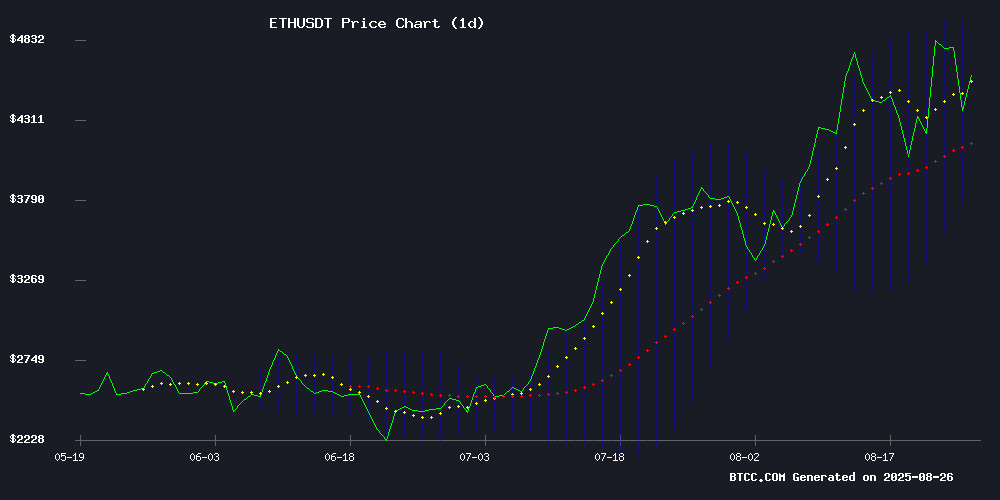

ETH is currently trading at $4,588.21, comfortably above its 20-day moving average of $4,408.99, indicating sustained bullish momentum. The MACD reading of -224.34 versus -318.09 signal line shows improving momentum despite negative territory, while the positive histogram of 93.75 suggests strengthening upward pressure. Trading within Bollinger Bands ($3,897.40-$4,920.57) with price NEAR the upper band reflects strong buying interest.

According to BTCC financial analyst James: 'ETH's position above the 20-day MA combined with MACD convergence suggests potential for continued upward movement. The Bollinger Band configuration indicates healthy volatility with room for further gains toward the $4,920 resistance level.'

Market Sentiment: Institutional FOMO Drives Ethereum Optimism

Current news sentiment surrounding ethereum remains overwhelmingly positive despite recent price consolidation. Headlines highlight institutional FOMO following ETH's all-time high, maintained bullish structure post-pullback, and billionaire endorsement of tokenization as a 2025 catalyst. Standard Chartered's assessment of ETH and ETH treasury companies as undervalued adds fundamental support to technical bullishness.

BTCC financial analyst James notes: 'The convergence of institutional interest, positive fundamental developments in tokenization, and analytical support from major financial institutions creates a favorable sentiment backdrop. While DeFi activity lagging price surge warrants monitoring, the overall narrative supports continued institutional accumulation and price appreciation potential.'

Factors Influencing ETH's Price

Ethereum ATH Sparks Institutional FOMO – Best Crypto to Buy Today?

Ether shattered its 2021 record, reaching $4,953.76 on August 24, 2025, as institutional demand surged. The rally coincides with robust ETF inflows and staking activity tightening supply.

Spot Ether ETFs snapped a four-day outflow streak with $287.6 million in net inflows last Thursday. Standard Chartered now projects ETH could hit $7,500 by year-end.

Nearly 30% of circulating supply remains locked in staking contracts, creating structural scarcity during price discovery. Network activity remains healthy with 584,921 daily active addresses during the breakout.

Ethereum Maintains Bullish Structure Despite Pullback from All-Time High

Ethereum briefly surpassed its all-time high this past Sunday before retracing, filling gaps left by last week's market movements. The retreat tested key levels, but the broader uptrend remains intact.

Since July, ETH has surged nearly 100% without significant retests of its 4-hour moving averages. The current pullback brings prices back toward these technical indicators, with the 4H 200MA/EMA now converging with the $4,000 support zone. This area represents a critical line in the sand for bulls.

Traders are watching two key thresholds: the $4,000 range low that must hold to preserve the bullish structure, and the $4,800-$5,000 range high that could trigger new price discovery. Sunday's failed breakout above the prior record high demonstrates lingering resistance, but the overall framework favors buyers.

Ethereum’s Secret Weapon in 2025? Tokenization, Says Billionaire Investor

Tokenization is reshaping asset settlement and liquidity, with Ethereum emerging as a primary beneficiary. Billionaire investor Yat Siu highlighted in a CNBC interview how smart contract platforms like Ethereum are leveraging tokenization to streamline workflows and enhance market depth. By mid-2025, on-chain tokenized real-world assets surged to $24 billion, marking a 380% increase from three years prior.

Ethereum’s robust infrastructure, including ERC-20 and ERC-721 standards, enables seamless interoperability for issuers and marketplaces. Its mature tooling and dense DeFi and NFT ecosystems reduce integration hurdles, fostering deeper liquidity pools and faster product iteration. Network effects further solidify Ethereum’s position, as lending, custody, and secondary markets increasingly rely on its rails.

Tokenization adoption is accelerating. Coinbase data reveals a 245x growth in RWA tokenization, from $85 million in April 2020 to over $21 billion by April 2025. This trend underscores Ethereum’s pivotal role in the institutional adoption of blockchain-based asset management.

Ether and ETH Treasury Companies Seen Undervalued Post-Plunge: Standard Chartered

Ether (ETH) and companies holding ETH treasuries appear undervalued following recent price declines, according to Standard Chartered's digital assets research head Geoff Kendrick. Institutional demand has absorbed 4.9% of circulating ETH supply since June through treasury purchases and ETF inflows.

The cryptocurrency briefly touched $4,955 last Sunday before retreating below $4,500. Kendrick maintains his $7,500 year-end price target, characterizing the dip as an attractive entry point. Treasury companies' valuations have normalized, with SharpLink Gaming and Bitmine Immersion now trading below MicroStrategy's crypto-to-market-cap ratio.

MIT Graduates Fight to Exclude Google Searches in $25M Crypto Exploit Case

Two MIT-educated brothers, Anton and James Peraire-Bueno, face charges of allegedly stealing $25 million in cryptocurrency through a blockchain exploit targeting Ethereum's MEV-boost system in April 2023. Federal prosecutors claim their Google searches—including queries for "top crypto lawyers" and "wire fraud statute of limitations"—demonstrate consciousness of guilt. The defendants argue these reflect routine legal consultations.

The case hinges on whether post-incident search history carries evidentiary weight. U.S. District Judge Jessica G.L. Clarke must determine if the brothers' technical background—used to allegedly intercept transactions within 12 seconds—shows criminal intent or prudent preparation during investigation. A conviction could result in 20-year prison sentences.

Ethereum DeFi Activity Fails to Keep Pace with ETH Price Surge

Ether's rally to a record $4,946 this week masks underlying weakness in decentralized finance activity. Total value locked across Ethereum's DeFi ecosystem remains stagnant at $91 billion—17% below its November 2021 peak. The divergence grows starker when measured in ETH terms, with just 21 million tokens currently locked versus 29.2 million during the last cycle.

Layer 2 solutions are cannibalizing liquidity as infrastructure evolves. Base, Arbitrum and Optimism collectively command billions in TVL, while staking protocols like Lido demonstrate how capital efficiency reduces bulk deposit requirements. "TVL metrics no longer tell the full story," observes Nick Ruck, noting improved protocol efficiency and cross-chain competition.

DEX volumes and perpetual trading flows show resilience but fail to match previous highs. This disconnect suggests institutional players may be driving the price action while retail participation lags—a structural shift that could redefine how ETH value accrues during market cycles.

Is ETH a good investment?

Based on current technical indicators and market sentiment, ETH presents a compelling investment opportunity. The cryptocurrency is trading above its key 20-day moving average with strengthening MACD momentum, while Bollinger Bands suggest room for upward movement toward $4,920.

Fundamentally, institutional FOMO following all-time highs, billionaire endorsements of tokenization prospects, and analytical support from institutions like Standard Chartered create a strong bullish narrative. The combination of technical strength and positive fundamental developments suggests ETH remains well-positioned for potential growth.

| Metric | Current Value | Signal |

|---|---|---|

| Price | $4,588.21 | Bullish (Above MA) |

| 20-Day MA | $4,408.99 | Support Level |

| MACD Histogram | +93.75 | Strengthening Momentum |

| Bollinger Upper | $4,920.57 | Near-Term Target |

However, investors should monitor DeFi activity levels and maintain appropriate risk management given cryptocurrency volatility.